Financial highlights

Revenue

(2023: €1,922m)

Cash generated from operations

(2023: €1,049m)

EBITDA

(2023: €887m)

Capital expenditure

(2023: €282m)

Net income

(2023: €270m)

Net cash

(2023: €1032m)

Reduced our water use by 10.5% compared to our baseline year of 2020

53% reduction in carbon emissions (scope 1 and 2) from our baseline year of 2019

Enriched enough uranium to generate an estimated 740,000 GWh of electricity from nuclear power, avoiding approximately 390 million tonnes of carbon emissions

Invested over €6.5 million in our social impact programme since 2021

Bulgaria

In March, Bulgaria’s Parliament ratified the intergovernmental agreement with the US on the construction of two nuclear reactors, at Kozloduy-7 and -8, which will use Westinghouse AP1000 technology.

Czech Republic

Like many countries, the Czech Republic is seeking to become more energy independent and reduce its reliance on fossil fuels. In July, South Korea’s KHNP won the Czech Government's competition for up to four new nuclear power units in the country. In September, the Czech Republic also chose UK’s Rolls-Royce SMR for a proposed SMR programme following an assessment of seven potential technology suppliers. The first SMR is planned by ČEZ at a site near the existing Temelín nuclear power plant in the 2030s.

France

In June, President Emmanuel Macron announced that France would now build eight new reactors, in addition to the six already announced (14 total), by 2050. Meanwhile, a significant milestone was reached in the future of French nuclear power as Jimmy Energy, now a Urenco customer for advanced fuels, submitted France’s first request for the construction of an SMR. And in December, EDF achieved the connection of the Flamanville-3, the first addition to the country's nuclear power network in 25 years. However, EDF also announced that it was going back to the drawing board on its Nuward SMR project, and changing the design to be more based on existing, proven technology.

Germany

Following the final s tage of its nuclear phase out policy in 2023, which saw all units shut down, the country continued its decommissioning and dismantling of power plants.

Netherlands

Prior to being sworn in, the coalition agreement of the new Dutch Government stated that the Netherlands should now aim to build four large reactors. The statement was made as preparation for the construction of two new reactors continues.

Poland

The updated Polish Nuclear Energy Programme envisages a three-year delay to 2036, for the start of commercial operation of Poland’s first nuclear power plant, followed by commercial operation of the next two units in 2037 and 2038.

Romania

Fluor Corporation, majority investor in Oregon-based SMR developer NuScale, and RoPower have signed an agreement that will enable Romania’s SMR project to move to a final investment decision and construction, with deployment targeted for 2029.

Slovak Republic

Slovakia’s Government has approved a plan to build another nuclear reactor, with an expected output of 1.2GW, at the Jaslovské Bohunice nuclear plant, where the utility Slovenské Elektrárne currently operates two nuclear units.

Sweden

In September, Sweden’s Prime Minister said that the country would begin construction on the first of two new nuclear reactors before the country's next election in 2026. It aims to put the first one into commission in the first half of the 2030s.

Switzerland

In August, the Swiss Government reported that it would seek to lift the country's ban on the construction of new nuclear power plants, which has been in place since 2018. It said all clean energy sources will be needed to meet future electricity demand.

UK

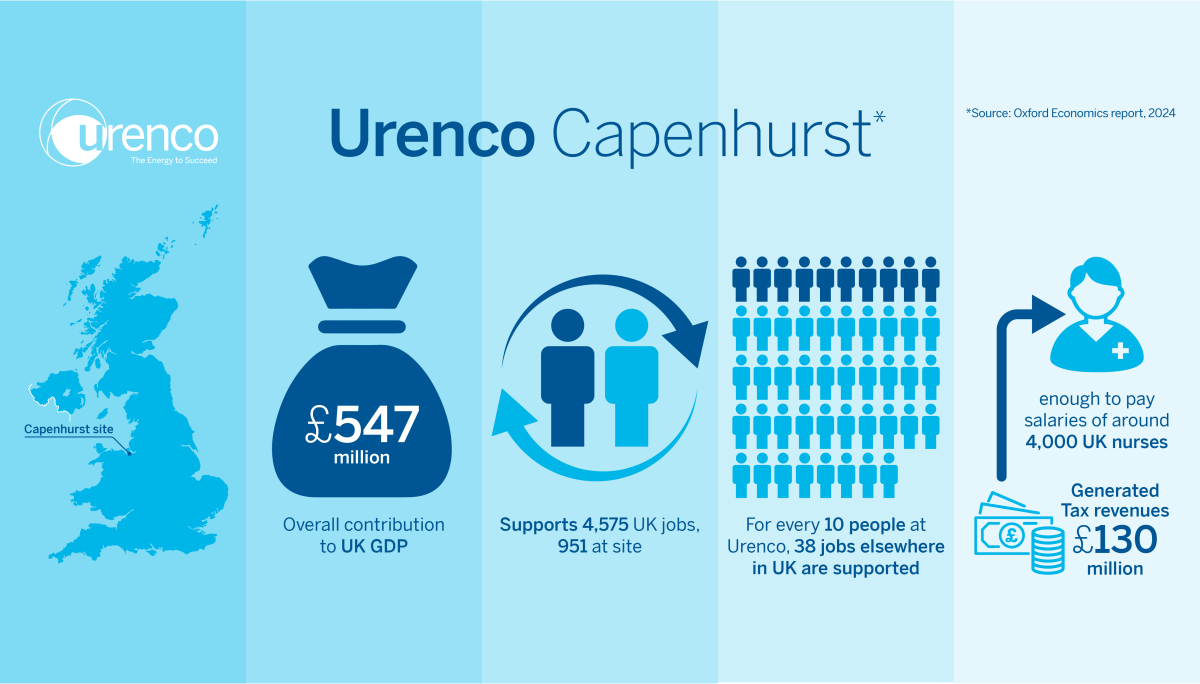

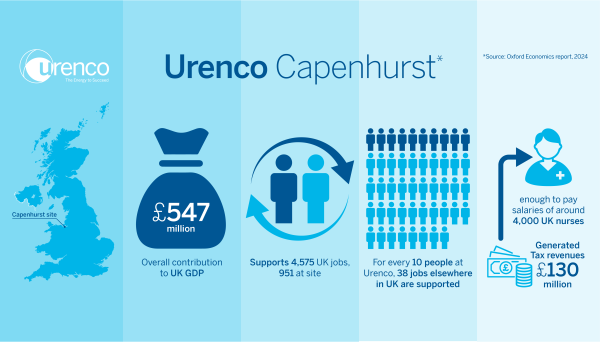

Despite the January setback that the Hinkley Point C project, the UK’s first new nuclear power station in two decades, was unlikely to be operational before 2030, with the overall cost also revised upwards, the year started off on a positive note. The government launched a roadmap to help it reach its ambition of 24GW of nuclear generating capacity by 2050, representing about 25% of the country's projected electricity demand. The roadmap also includes a government ambition to secure 3–7GW worth of investment decisions every five years from 2030 to 2044 on new nuclear projects. Meanwhile, EDF Energy announced it would invest £1.3 billion in the UK's five operating nuclear power plants over the next two years, while the lives of the four operating Advanced Gas-cooled Reactor (AGR) plants, Heysham 1 & 2, Hartlepool, and Torness, were extended for up to two years.

In September, the UK Department for Energy Security and Net Zero (DESNZ) announced £5.5 billion in subsidies from a new development expenditure subsidy scheme for the Sizewell C nuclear power plant project. This followed an announcement, in May, that the Office for Nuclear Regulation (ONR) had granted a nuclear site licence to install and operate a nuclear power station at Sizewell C in Suffolk. A final investment decision is due in 2025.

On the SMR front, Great British Nuclear (GBN) began detailed negotiations in November with the four shortlisted bidders in the UK’s SMR competition. Final decisions are to be taken in spring 2025. While in February, Community Nuclear Power (CNP) and Westinghouse announced the first privately funded project deploying SMRs anywhere in Europe. Their agreement will see four AP300 SMRs built in the North Teesside region of north-east England, with the first up and running in the 2030s.

USA

Federal and state support has positioned the Palisades Nuclear power plant in Michigan to become the US’ first shut-down nuclear power plant to be recommissioned. The single unit plant is on track to restart in 2025 after owner, Holtec, received public funding. In September, Constellation Energy announced plans to restart the Three Mile Island nuclear plant in 2028 following a 20 year agreement with Microsoft to power its data centres. Unit-1 previously ceased operations in 2019. Additionally, in October, NextEra Energy said it is exploring the possible restart of its closed Duane Arnold nuclear power plant in Iowa.

Advanced reactors also benefitted from the prospective demand from data centres. In October, Amazon and X-energy announced a collaboration to bring more than 5GW of new power projects online across the US by 2039, representing the largest commercial deployment target of SMRs to date. The companies will initially support a four-unit 320MW project with regional utility Energy Northwest. Amazon also signed an agreement with Dominion Energy to explore the development of an SMR project near Dominion’s existing North Anna nuclear power station, noting that this would bring at least 300MW of power to the Virginia region. In the same month, Kairos Power and Google signed an agreement to develop, build, and operate a series of advanced reactor power plants by 2035 to power Google’s data centres. The first reactor could be operational by 2030. In December, Meta said that it is seeking proposals from developers to help meet its artificial intelligence and environment goals, noting that it wants to add 1-4GW of new US nuclear generation capacity from the early 2030s.

The US also experienced successful new build developments. In April, the US’ newest nuclear reactor, Vogtle-4, began commercial operations, becoming only the second newly constructed nuclear unit in the US in more than 30 years (with Vogtle-3, entering commercial operation in July 2023). Meanwhile, in November, the US Nuclear Regulatory Commission (NRC) took a historic step by voting to issue construction permits for Kairos Power’s 70-MWth Hermes 2, a “low power” advanced test facility comprising two 35-MWth molten salt reactors. Hermes 2 could begin operation by December 2027.

China

China has approved 11 nuclear reactors across five sites, a record number in one year. This follows two successive years of approving 10 new reactors, as the government leans even more heavily into nuclear energy to support its push to cut emissions.

Japan

The number of reactor restarts in Japan following the Fukushima incident has now reached 14 units as both Tohoku Electric’s Onagawa-2 and Chugoku Electric Power's Shimane-2 resumed operations after being taken offline more than 13 years ago. The restarts were also notable as they marked the first and second restarts of boiling water reactors (BWRs) since the incident occurred. The restart of the two BWRs could pave the way for Japan’s nuclear restoration, as 15 BWRs, including advanced BWRs, are still closed in the wake of the incident.

South Korea

In April, KHNP started commercial operation of Shin Hanul-2, bringing South Korea’s combined nuclear capacity up to 26GW. In October, KHNP announced that it had started works to build Shin Hanul-3 and -4, with commercial operation targeted for 2032 and 2033, respectively. The government also seeks to extend operating lifespans of nuclear reactors and push for the construction of SMRs.

UAE

The UAE will reportedly tender for the construction of four new reactors, with the aim to have them operational by 2032 in order to meet projected energy needs. Meanwhile, the fourth and final unit at the Barakah nuclear power plant began commercial operation in September, marking the full delivery of a project that will generate 25% of the UAE’s electricity needs.

-

Bulgaria

Bulgaria

In March, Bulgaria’s Parliament ratified the intergovernmental agreement with the US on the construction of two nuclear reactors, at Kozloduy-7 and -8, which will use Westinghouse AP1000 technology.

-

Czech Republic

Czech Republic

Like many countries, the Czech Republic is seeking to become more energy independent and reduce its reliance on fossil fuels. In July, South Korea’s KHNP won the Czech Government's competition for up to four new nuclear power units in the country. In September, the Czech Republic also chose UK’s Rolls-Royce SMR for a proposed SMR programme following an assessment of seven potential technology suppliers. The first SMR is planned by ČEZ at a site near the existing Temelín nuclear power plant in the 2030s.

-

France

In June, President Emmanuel Macron announced that France would now build eight new reactors, in addition to the six already announced (14 total), by 2050. Meanwhile, a significant milestone was reached in the future of French nuclear power as Jimmy Energy, now a Urenco customer for advanced fuels, submitted France’s first request for the construction of an SMR. And in December, EDF achieved the connection of the Flamanville-3, the first addition to the country's nuclear power network in 25 years. However, EDF also announced that it was going back to the drawing board on its Nuward SMR project, and changing the design to be more based on existing, proven technology.

-

Germany

Following the final s tage of its nuclear phase out policy in 2023, which saw all units shut down, the country continued its decommissioning and dismantling of power plants.

-

Netherlands

Prior to being sworn in, the coalition agreement of the new Dutch Government stated that the Netherlands should now aim to build four large reactors. The statement was made as preparation for the construction of two new reactors continues.

-

Poland

The updated Polish Nuclear Energy Programme envisages a three-year delay to 2036, for the start of commercial operation of Poland’s first nuclear power plant, followed by commercial operation of the next two units in 2037 and 2038.

-

Romania

Fluor Corporation, majority investor in Oregon-based SMR developer NuScale, and RoPower have signed an agreement that will enable Romania’s SMR project to move to a final investment decision and construction, with deployment targeted for 2029.

-

Slovak Republic

Slovak Republic

Slovakia’s Government has approved a plan to build another nuclear reactor, with an expected output of 1.2GW, at the Jaslovské Bohunice nuclear plant, where the utility Slovenské Elektrárne currently operates two nuclear units.

-

Sweden

In September, Sweden’s Prime Minister said that the country would begin construction on the first of two new nuclear reactors before the country's next election in 2026. It aims to put the first one into commission in the first half of the 2030s.

-

Switzerland

Switzerland

In August, the Swiss Government reported that it would seek to lift the country's ban on the construction of new nuclear power plants, which has been in place since 2018. It said all clean energy sources will be needed to meet future electricity demand.

-

UK

Despite the January setback that the Hinkley Point C project, the UK’s first new nuclear power station in two decades, was unlikely to be operational before 2030, with the overall cost also revised upwards, the year started off on a positive note. The government launched a roadmap to help it reach its ambition of 24GW of nuclear generating capacity by 2050, representing about 25% of the country's projected electricity demand. The roadmap also includes a government ambition to secure 3–7GW worth of investment decisions every five years from 2030 to 2044 on new nuclear projects. Meanwhile, EDF Energy announced it would invest £1.3 billion in the UK's five operating nuclear power plants over the next two years, while the lives of the four operating Advanced Gas-cooled Reactor (AGR) plants, Heysham 1 & 2, Hartlepool, and Torness, were extended for up to two years.

In September, the UK Department for Energy Security and Net Zero (DESNZ) announced £5.5 billion in subsidies from a new development expenditure subsidy scheme for the Sizewell C nuclear power plant project. This followed an announcement, in May, that the Office for Nuclear Regulation (ONR) had granted a nuclear site licence to install and operate a nuclear power station at Sizewell C in Suffolk. A final investment decision is due in 2025.

On the SMR front, Great British Nuclear (GBN) began detailed negotiations in November with the four shortlisted bidders in the UK’s SMR competition. Final decisions are to be taken in spring 2025. While in February, Community Nuclear Power (CNP) and Westinghouse announced the first privately funded project deploying SMRs anywhere in Europe. Their agreement will see four AP300 SMRs built in the North Teesside region of north-east England, with the first up and running in the 2030s.

-

USA

Federal and state support has positioned the Palisades Nuclear power plant in Michigan to become the US’ first shut-down nuclear power plant to be recommissioned. The single unit plant is on track to restart in 2025 after owner, Holtec, received public funding. In September, Constellation Energy announced plans to restart the Three Mile Island nuclear plant in 2028 following a 20 year agreement with Microsoft to power its data centres. Unit-1 previously ceased operations in 2019. Additionally, in October, NextEra Energy said it is exploring the possible restart of its closed Duane Arnold nuclear power plant in Iowa.

Advanced reactors also benefitted from the prospective demand from data centres. In October, Amazon and X-energy announced a collaboration to bring more than 5GW of new power projects online across the US by 2039, representing the largest commercial deployment target of SMRs to date. The companies will initially support a four-unit 320MW project with regional utility Energy Northwest. Amazon also signed an agreement with Dominion Energy to explore the development of an SMR project near Dominion’s existing North Anna nuclear power station, noting that this would bring at least 300MW of power to the Virginia region. In the same month, Kairos Power and Google signed an agreement to develop, build, and operate a series of advanced reactor power plants by 2035 to power Google’s data centres. The first reactor could be operational by 2030. In December, Meta said that it is seeking proposals from developers to help meet its artificial intelligence and environment goals, noting that it wants to add 1-4GW of new US nuclear generation capacity from the early 2030s.

The US also experienced successful new build developments. In April, the US’ newest nuclear reactor, Vogtle-4, began commercial operations, becoming only the second newly constructed nuclear unit in the US in more than 30 years (with Vogtle-3, entering commercial operation in July 2023). Meanwhile, in November, the US Nuclear Regulatory Commission (NRC) took a historic step by voting to issue construction permits for Kairos Power’s 70-MWth Hermes 2, a “low power” advanced test facility comprising two 35-MWth molten salt reactors. Hermes 2 could begin operation by December 2027.

-

China

China has approved 11 nuclear reactors across five sites, a record number in one year. This follows two successive years of approving 10 new reactors, as the government leans even more heavily into nuclear energy to support its push to cut emissions.

-

Japan

The number of reactor restarts in Japan following the Fukushima incident has now reached 14 units as both Tohoku Electric’s Onagawa-2 and Chugoku Electric Power's Shimane-2 resumed operations after being taken offline more than 13 years ago. The restarts were also notable as they marked the first and second restarts of boiling water reactors (BWRs) since the incident occurred. The restart of the two BWRs could pave the way for Japan’s nuclear restoration, as 15 BWRs, including advanced BWRs, are still closed in the wake of the incident.

-

South Korea

In April, KHNP started commercial operation of Shin Hanul-2, bringing South Korea’s combined nuclear capacity up to 26GW. In October, KHNP announced that it had started works to build Shin Hanul-3 and -4, with commercial operation targeted for 2032 and 2033, respectively. The government also seeks to extend operating lifespans of nuclear reactors and push for the construction of SMRs.

-

UAE

The UAE will reportedly tender for the construction of four new reactors, with the aim to have them operational by 2032 in order to meet projected energy needs. Meanwhile, the fourth and final unit at the Barakah nuclear power plant began commercial operation in September, marking the full delivery of a project that will generate 25% of the UAE’s electricity needs.

- Over 2,550 highly skilled and well-trained employees, supported through employee engagement initiatives

- Leading centrifuge technology

- Safe, well-maintained operations

- Reliable transatlantic transportation services

- Research & Development (R&D) programmes

- Strong customer service

- Rigorous supplier and compliance audits

- Advanced market intelligence

- Robust commitment to nuclear safeguards and non-proliferation through the Treaties of Almelo,

- Washington and Cardiff and government oversight

- Integrated and diverse nuclear fuel supply to deliver energy security

- Progression of the capacity programme to ensure that demand is matched by supply for customers

worldwide - Evolution of the nuclear fuel cycle through the development of advanced fuels for next-generation

reactors, including LEU+ (low enriched uranium up to 10%) and HALEU (high-assay low-enriched

uranium up to 19.75%) - Commitment to reduce our emissions from our direct operations (scopes 1 and 2) by 90% and our supply

chain (scope 3) by 30% by 2030, with the goal of being a sustainable, net zero business by 2040 - Enhanced isotopes offering for medical, industrial and research applications

- Responsible nuclear stewardship, including materials management and decommissioning

- Revenue: €1,877 million (2023: €1,922 million)

- EBITDA(i): €728 million (2023: €887 million)

- Net income: €180 million (2023: €270 million)

- Cash generated from operations: €668 million (2023: €1,049 million)

- Capital expenditure(ii): €471 million (2023: €282.0 million)

- Net cash: €893 million (2023: €1,032 million)

- Contract order book extending into the 2040s; its value as of 31 December 2024 grew to €18.7 billion

(2023: €14.7 billion) - Investment grade credit ratings: S&P Global: A- (stable outlook); Moody’s: Baa1 (stable outlook)

(i) EBITDA is earnings before exceptional items, interest (including other finance costs), taxation, depreciation and amortisation and results from joint venture and other investments. Depreciation and amortisation are adjusted to remove elements of such charges included in changes to inventories and net costs of nuclear provisions. Further details on the calculation of EBITDA are set out in note 4 to the Group’s Consolidated Financial Statements contained in the Annual Report and Accounts.

(ii) Capital expenditure includes net cash flows on the purchases of property, plant and equipment and intangible assets of €462.7 million (2023: €278.4 million) and on the decrease of capital accruals of €8.7 million (2023: €3.9 million) (included in working capital payables).

- Global enrichment capacity of 17.3 million tSW/a (2023: 17.6 million)

- Enriched enough uranium to generate an estimated 740,000 GWh of electricity from nuclear power,

avoiding approximately 390 million tonnes of carbon emissions - Our uranium enrichment services provided:

enough fuel to generate the power supply for more than 90% of all the households in the EU and UK for one

year or more than 50% of all the households in the US for one year - More than 50 customers in 20 countries

- 100% of customer deliveries met

- Volume of annual isotopes’ sales equates to more than two million patient treatments being performed

using medical radioisotopes produced from our products - Total Recordable Injury Rate (TRIR) of 0.291 as a result of 10 total recordable injuries (2023: TRIR 0.248)

- Carbon emissions decreased by 33% (scopes 1 and 2 – direct and indirect emissions) from 2023, and fell

by 53% from 2019 baseline year - Water withdrawal increased slightly compared to 2023, but remains below the baseline year of 2020 by 10.5%

- Reduced our total energy use by 3% compared to 2023

- New charitable/social impact partnerships established, supporting educational goals

- Global ‘Richie’ STEM education programme has reached around 55,000 children in 2024

.jpg) April 2024

April 2024.jpg) April 2024

April 2024 May 2024

May 2024 May 2024

May 2024 June 2024

June 2024 June 2024

June 2024 July 2024

July 2024 July 2024

July 2024 August 2024

August 2024 August 2024

August 2024 September 2024

September 2024 September 2024

September 2024 October 2024

October 2024 October 2024

October 2024 October 2024

October 2024 October 2024

October 2024 December 2024

December 2024 December 2024

December 2024 December 2024

December 2024 December 2024

December 2024